Sense, telematics car insurance that rewards good driving.

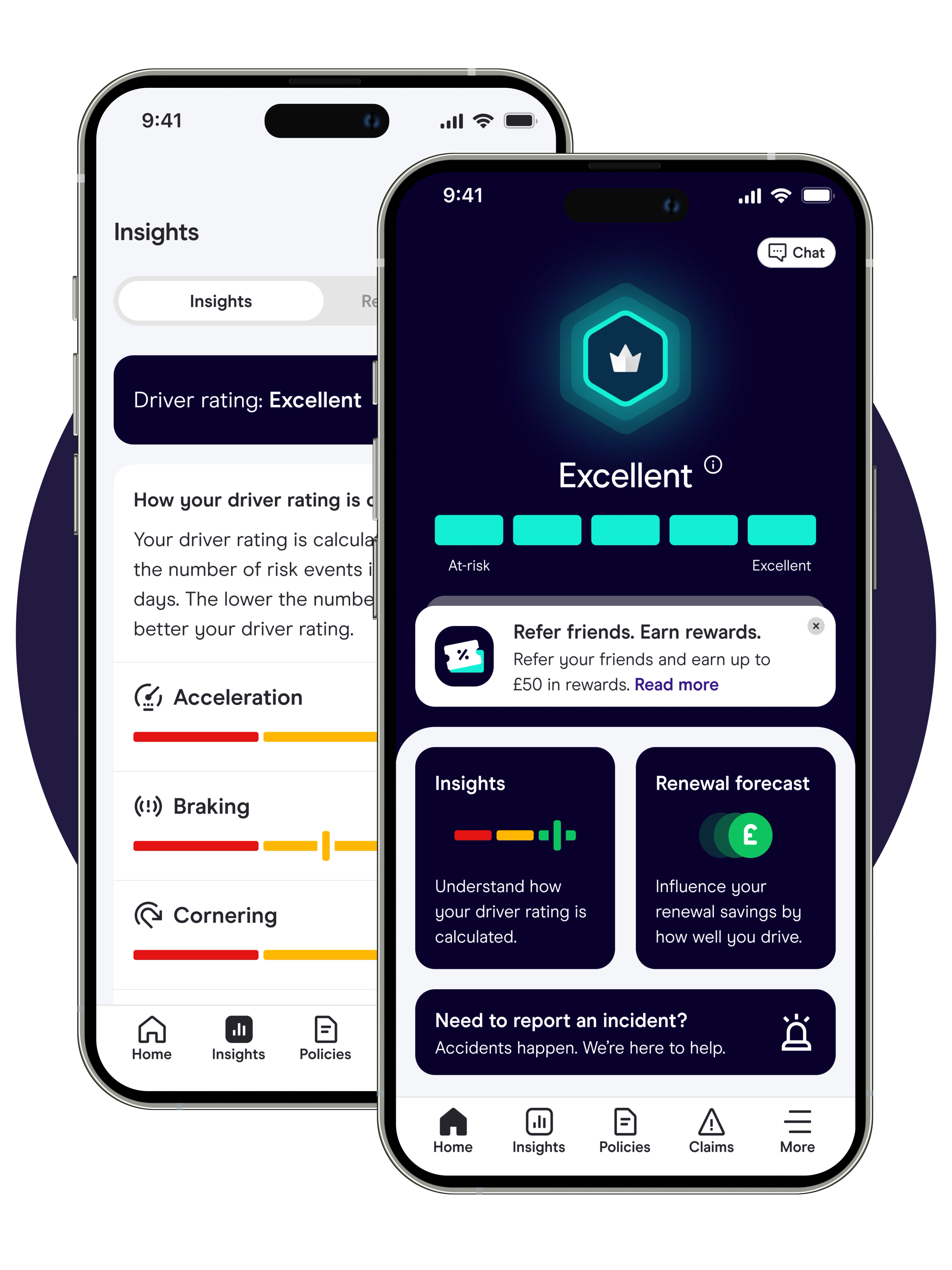

App-based telematics insurance – no black box needed

Renewal price based on how you drive

Manage everything in the Sense app

What Is Telematics Insurance?

It’s great for anyone who wants more control over their insurance costs. Telematics also helps improve driving habits through feedback and scoring, encouraging safer, smoother driving over time.

With modern app-based telematics, there’s no intrusive black box and no guesswork, just clear insight into how your driving affects your price. If you’re a confident, careful driver, telematics insurance is one of the most effective ways to avoid overpaying for cover.

Insurance that moves with you. It starts with Sense.

Simple as that.

1. Download the Sense app

2. Start driving

3. Unlock our best price at renewal

Is telematics car insurance right for me?

Telematics insurance could lower your premium. It focuses on how you drive – not just how long you’ve held your licence.

Telematics works well for low-mileage drivers too. If you don’t drive much, your premium reflects that.

Safe drivers benefit most. Smooth braking, steady speeds and smart cornering all help bring your renewal down.

What’s Included in Your Sense Telematics Policy

Our cover includes:

- Everyday driving and commuting to a single place of work or study (SD&P)

- Personal accident cover up to £5,000

- Key and lock cover up to £500

- The loss, damage or theft of your vehicle and its spare parts

- Personal belongings cover up to £300

- Audio, communication and navigation equipment cover up to £500

- Costs for causing damage to other vehicles or property up to £5m

- Windscreen cover (£25 excess for repairs or £150 for replacement)

- Courtesy vehicle while yours is being repaired (with an approved repairer)

Why Sense is the right choice

100% app-based telematics policy – no black box needed

Renewal price based on how you drive, not just your age or job title

Real-time driving insights sent straight to your phone

Full policy control, all in the Sense app

Why Drivers Trust Zego

81m

575k

96%

Is Sense right for you?

- I'm 25–60 years old

- I live in the UK

- I have no previous claims or motoring convictions

- I hold a full or provisional UK driver’s licence

- My car is valued at less than £30,000

Trusted by 100,000’s of UK drivers

Read About Telematics Insurance

Is Telematics Insurance Cheaper?

Here we explain if telematics insurance can really save you money vs regular car insurance.

What’s the Difference Between Telematics and Black Box Insurance?

Is telematics just the same as black box? Lets find out...

How to improve your driver rating

Find out how Zego really calculates your driver rating which can affect your renewal premium.

Sense telematics insurance FAQs

“81 million...” – Based on the total number of policies sold by Zego as of 23/07/25

“575K drivers...” – Based on the number of fixed policies sold by Zego as of 23/07/25

“96%..” – Based on Zego customers who have been insured on Sense policies and have a driver rating, between 01/06/2025 and 01/08/2025